Embracing new technology helps Rowlands Webster address industry changes

Based in Bournemouth, Rowlands Webster provide a range of accounting and tax advisory services. Managing Director, Mark Rowlands first established the practice in 2004 as a sole trader. In 2008, Janice Webster joined as a partner and the business became a private limited company.

Mark had over 20 years’ experience working in accountancy prior to branching out with his own practice. Looking back, Mark recalls a simpler time in the profession, before an era of digital transformation began to gain momentum.

Mark Rowlands, Managing Director (Rowlands Webster)

“In the pre-computing age, the extent of useful technology in an accountants practice was a calculator and a typewriter. In those days accounts presentation and tax returns were simpler. The advent of technology has extended our capabilities – be that in reporting to shareholders, the tax authority or business managers. Technology enables complexity, which then requires technology to cope with that complication. We become the servant of technology as much as it serves us.”

In the modern quandary Mark presents, you’d might assume he has a negative view on the role technology plays in our lives and the world of work. In fact, as is the case for many of us, the truth is far more nuanced.

“I have always loved technology and have been fortunate to have been given computers to play with when they first became a tool for small business in the early 1980’s. Early frustration with technology was always around saving work (or not saving it) and backing up, which were manual tasks and time consuming. Definitely a lack of automation was frustrating. We always thought technology could be so much better – really, we imagined it as it is now, which is a step change to even how it was even a few years ago.”

A paperless approach

Mark’s journey with technology has included a number of milestone moments throughout his career and the evolution of Rowlands Webster.

“Becoming paperless in 2004 and getting rid of all paper files when moving to our Westbourne office in 2006 was a transformation. The efficiency in being able to access all documents without leaving our desks was a significant improvement, as was the end of the need for storage space. Another step change was development of our professional software in using a central database to bring together all the different software arms that an accountancy practice requires.”

Navigating the pandemic

The escalating circumstances that characterised the early days of the COVID pandemic in 2020, forced the hand of many businesses to adopt new technologies and working practices, with little breathing space to consider the available options.

It was during this time that Rowlands Webster made the move to a hosted virtual desktop, with mixed initial results.

“We had a terrible experience by picking the wrong supplier to host and had 9 months of firefighting until we managed to extricate ourselves from the contract and moved to Grapevine, who gave us the perfect solution that worked as the business tool that a virtual desktop is meant to be from the start. Video meetings also have become more common place, with clients becoming familiar with the technology during COVID lockdown.”

Legislative challenges

As the uncertainty brought about by the pandemic settles, fresh challenges for businesses begin to reveal themselves. For Mark and the Rowlands Webster team, industry specific issues continue to be a burden on day-to-day operations.

“Anti-Money Laundering and Data Protection legislation have become significant issues – not only do we need to ensure that clients are legitimate, and data protected, we need to be seen to do so, which has increased our bureaucracy substantially. Client onboarding has become a costly exercise because of it.”

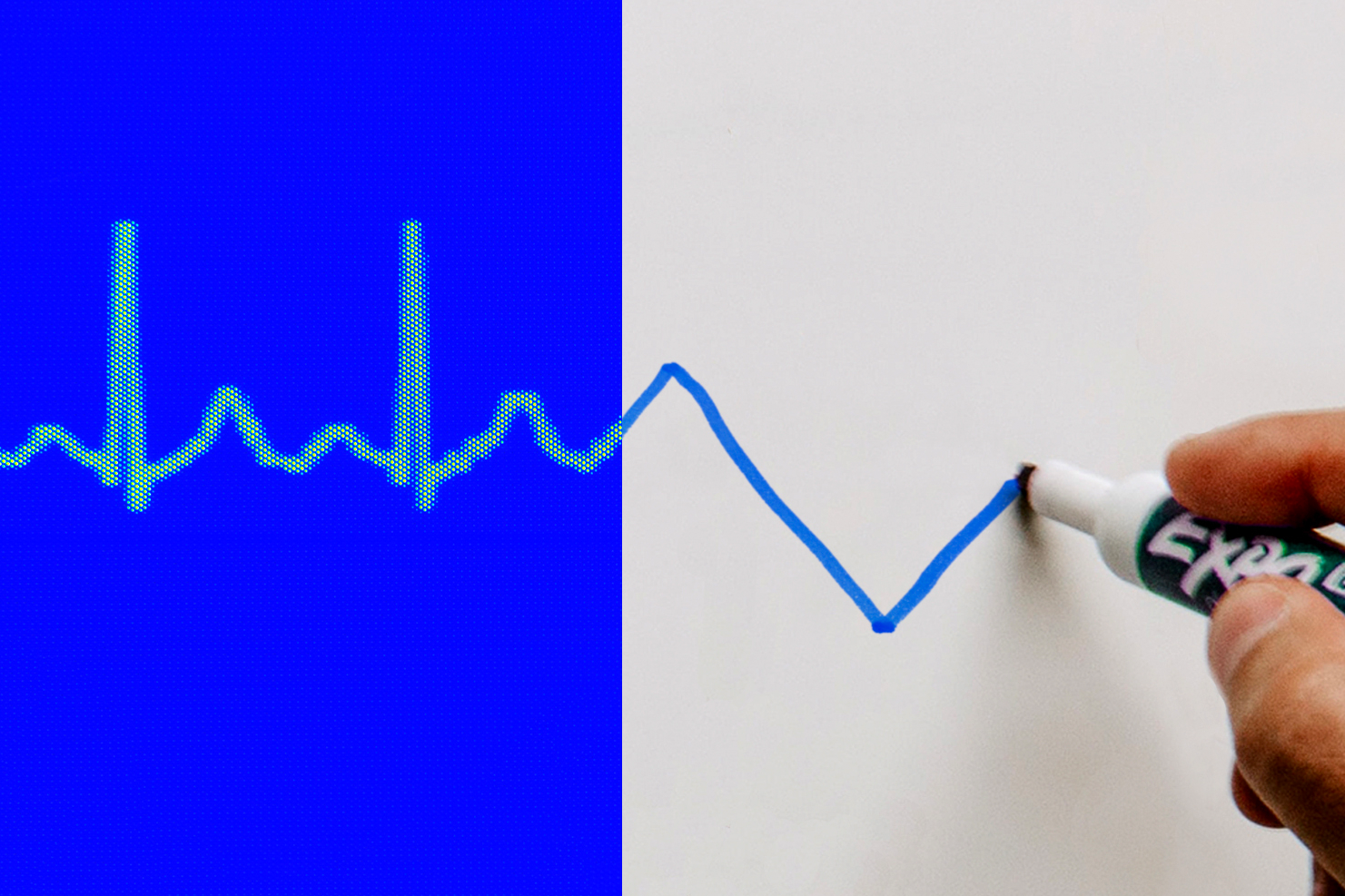

Recognising the duality of technology, Mark sees its role in business as being both the curse and the cure. This is particularly true of the next challenge on the horizon for tax advisers, Making Tax Digital, as Mark explains.

“From this year all VAT registered businesses need to report under MTD and from April 2024 self-employed businesses and landlords with turnover above £10,000 report under MTD for income tax. Companies join MTD for Corporation Tax from April 2026. MTD for VAT was not so much of an issue because it was standard to report quarterly, it just needed to be done electronically. For income tax, quarterly submissions will be a change and, for us, ensuring that clients meet those deadlines will be yet another administrative burden that we need to cope with. Technology is the cause of the burden and will be what will make it achievable.”

Looking ahead

Mark is optimistic despite the current economic climate. This open-minded culture on new technologies at Rowlands Webster continues to play a key part as the company takes great strides forward.

“We try to remain fluid and adaptable, embracing technology to keep us relevant in the market. We hope that this attitude will enable the company to accommodate the next generation and for us to make our clients’ lives simpler for many years to come.”

To learn more about Rowlands Webster please visit rowlandswebster.co.uk

Support for your business More client stories

Note: Since this article was first published HMRC announced (19/12/2022) that Making Tax Digital (MTD) for Income Tax Self-Assessment (ITSA) will be delayed for two more years until April 2026.